www.bestbuy.com/creditcard – How To Apply Best Buy Credit Card Online

Best Buy Credit Card Review:

About Best Buy

Best Buy is a multinational electronic retailer in America. Headquarters of Best Buy is located in Richfield, Minnesota. It was first started on August 22, 1966, by the Richard M. Schulze and James Wheeler. In 1966, when it was first started, it was known as The Sound of Music. In the year 1983, they rebrand it as the Best Buy. Throughout the United States, Mexico, and Canada, there are around 997 retail locations.

Best Buy Credit Card

Best Buy is one of the best store cards in the market. There are mainly two cards available from the Best Buy, store credit card or a Visa. You can get to choose between these two cards. It ultimately depends on your creditworthiness, which card you will get. But in both cards, you will receive 5% back on the Best Buy purchases. You might like this card because of the rewards earnings. With the no annual fees for this card is one of the great shop credit cards.

The Available Best Buy Credit Cards:

There are mainly two types of credit cards available from Best Buy:

My Best Buy Credit Card:

This Best Buy Credit Card is actually a store card, which is only accepted at the Best Buy and BestBuy.com. For this card, there will be no annual fees.

My Best Buy Visa:

This is one of the great cards offered by Best Buy. You can use your Best Buy Visa card anywhere Visa card is accepted. There are two categories in this card with a significant difference in the annual fee. At the time of applying, you will get the info about which one you have been approved for:

Gold: For the Best Buy Visa Gold card, you will be charged the annual fee of $59.

Platinum: For the Best Buy Platinum card, there will be no annual fees.

When you will apply for the Best Buy Card, firstly you will be considered for the My Best Buy Visa Platinum. In case, you not get qualify for the card, then you will consider for My Best Buy Credit Card Preferred and finally for the My Best Buy Visa Gold.

Should You Get Best Buy Credit Card?

If you frequently shop at Best Buy, then Best Buy will be a good fit. Because your rewards are only redeemable at the Best Buy store. If you spend regularly at the Elite Plus or Elite levels, then your Best Buy credit card will beat the bank card.

Pros of Cons of Best Buy Credit Card:

Pros:

- You will get 2.5 points for every $1 in Best Buy purchases. After you complete the earning 250 points, you will receive $5. On your Best Buy purchases, you will get the 5% back. You can redeem your cashback for the more Best Buy buying.

- You can make the purchase at everywhere else using your Best Buy Visa Card, you will get the 2% cashback. If you get qualified for the Best Buy Visa Credit Card, that means you must have a very good credit score. While buying items from the other merchants, you will get the earn more Best Buy rewards points.

- For the Best Buy Visa Credit Card, you don’t have to pay an annual fee. In case, you don’t get approved for the store card, then you might be offered the Gold Visa Credit Card, which charges a $59 annual fee.

Cons:

- There are only a few financial offers are available for the Best Buy cardholders to choose from.

- Based on the terms and conditions, Best Buy Store Card or Gold Visa Card, have a 25.24% regular APR, which is very high.

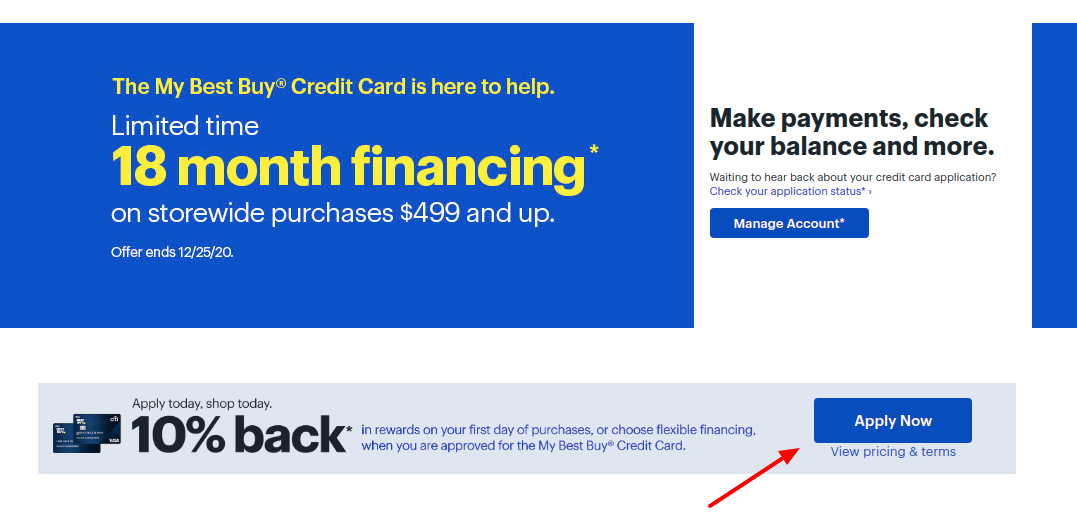

How to Apply for the Best Buy Credit Card:

The application process for Best Buy is very simple. You just need to follow some basic instructions to complete the application process:

- First, you have to visit this link www.bestbuy.com/creditcard.

- Then, you need to click on the Apply Now option.

- You will require a Best Buy account to complete the application process.

- Enter your email address and password on the given fields.

- After that, you need to click on the Sign In button.

- Then, follow the further steps to complete the application process.

Other Things to Consider:

- My Best Buy Elite Plus Members Get Added Perks:

By spending at least $3,500 on your card within a calendar year at Best Buy, you will get the My Best Buy Elite Plus status. After achieving this status, you can earn an extra 0.5 points on your every $1. With the Elite membership, you will get an extra 15 days to return or exchange items, along with free shipping.

- Rewards Dispensed as Best Buy Gift Certificates:

You will get the Best Buy rewards in the form of points. When you complete earning the 250 points, then you can redeem that for the $5.

Also Read : Apply Your First Access Credit Card Online

Best Buy Customer Support:

If you have any queries about the Best Buy credit card, then you can contact the customer service team:

1-888-BEST BUY (1-888-237-8289)

Conclusion:

If you shop at Best Buy occasionally, then Best Buy is not for you. But if you purchase at Best Buy frequently, then you can go for the Best Buy Credit Card. This card comes with some of the exciting benefits.

Reference Link: