www.sofi.com – How to Apply SoFi Personal Loan Online

SoFi Personal Loan Review:

About SoFi

Social Finance, Inc. is a personal finance company, which offers mortgages, student loans, personal loans, etc. Dan Macklin, Mike Cagney and Ian Brady and James Finnigan, they all together started the SoFi in 2011. Headquarters of the SoFi is located in San Francisco, California, United States. SoFi offers affordable options for lending to their customers.

Eligibility for SoFi

You will require great credit to get the SoFi competitive loan rates. The qualification for the loan depends on several factors, such as your income, credit score, and responsible credit history. Also, you have to be a legal resident of the United States to get qualified.

Minimum FICO Score

Most of the SoFi borrowers have above 700 FICO scores. In the SoFi loans analysis, above 60% of the borrowers had a super-prime credit score of 740 or above.

Minimum Income

To get qualified for the SoFi personal loan, your gross income has to be at least $50,000. Few borrowers got approved for the SoFi personal loan with less than $50,000 gross income.

Pros and Cons of SoFi Personal Loan:

Pros Explained:

- Competitive Interest Rates:

The SoFi personal loans start with a very low-interest rate of 5.99%. Only a few applications get qualified for the SoFi’s lowest interest rate. In order to get qualified for the lowest interest rate, you have to show your responsible financial history, sufficient income, and other required conditions.

- Pay Zero Fees to Borrow:

With the SoFi personal loan, you won’t be charging any fees. Even, you don’t have to pay the late fees. That makes this loan more affordable for the borrowers. You might get the same APR elsewhere, but they will charge fees for that. In that situation, SoFi will be a better choice.

- High Loan Amount:

With the SoFi personal loan, you can borrow up to $100,000. On the personal loans, you will also get the co-applicants features. So, if are looking for a large loan amount, then this could work in your favor.

Also Read : Manage Your NetSpend Prepaid Debit Card Online

Cons Explained:

- Good Credit Needed:

To get qualified for the SoFi personal loan, you will require the minimum score score of 680. In case, your credit score falls below, then you need to work on your credit score improvement. Otherwise, you have to consider the different lenders in the meantime.

- Borrowers with Excellent Credit:

With an excellent credit score, you might get the lower interest rates, that can help you to save when you borrow money. But if you have a poor credit score, then you might charge high fees. Then, you will not probably go for the SoFi personal loan.

- Slow Funding Process:

With some of the borrowers, you will get the money as soon as the day you apply. But SoFi personal loans takes to much time to proceed. So, if you want the cash as soon as possible, then SoFi might not be the best deal for you. After you get the approval for the loan, you will receive a call to verify the information on your application.

How to Take Out a Personal Loan with SoFi:

Before applying for the SoFi loan, you should check your credit report first. You have to fix your credit score if there is an issue. The slightest improvement in your credit score might help you to get better rates.

You can easily check your rates using soft credit inquires. It will not hurt your credit score. SoFi offers a simple online loan application and live customer support seven days a week.

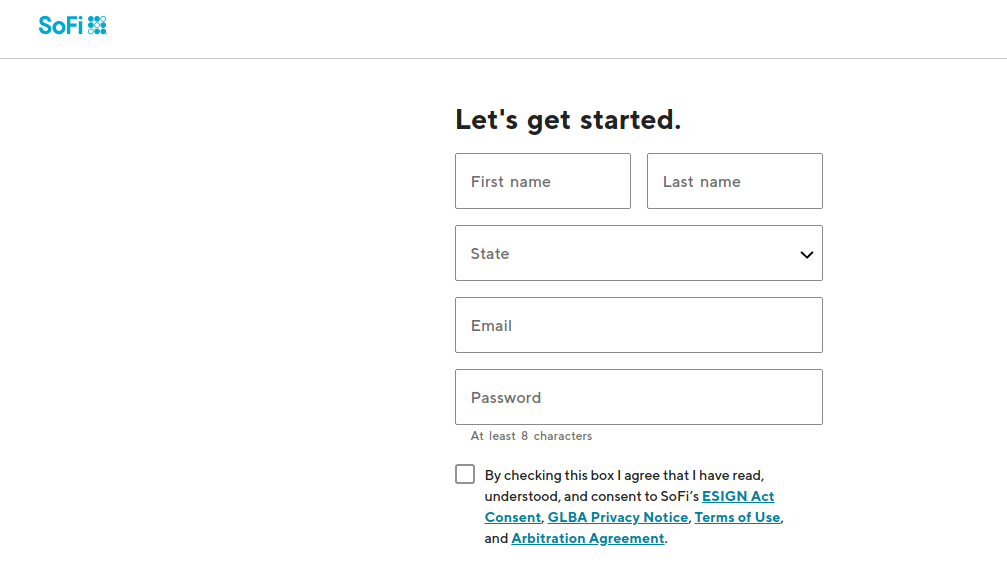

To apply for the SoFi personal loan, you have to follow these instructions:

- First, you have to visit the official website of the SoFi.

- Or, you can simply click on this link www.sofi.com, for direct access to the website.

- Then, you need to click on the Find My Rate option.

- Then, you have to click on the Personal Loans option.

- You have to enter your first and last name on the first field.

- Choose your state from the list.

- Then, simply provide your email ID on the next field.

- Then, create your password in the text field.

- After that, simply click on the Next button for further steps.

SoFi Customer Service:

For any quarries about the SoFi personal loan, you can contact the customer service at:

Phone:

General: (855) 456-SOFI (7634)

Mon – Thu: 5 am – 7 pm PT

Fri – Sun: 5 am – 5 pm PT

Email: customerservice@sofi.com

Mail:

Personal Loans:

SoFi Lending Corp Personal Loans

PO Box 734297

Dallas, TX 75373-4297

Conclusion:

With the low-interest rates and no fees, SoFi is a perfect choice. Within a few minuties, you can apply for the SoFi loan online. For more informaitons, regarding the SoFi personal loan, you can apply online.

Reference Link: