capitalone.com/credit-cards – How To Apply Capital One Savor Review Credit Card Online

Capital One Savor Review:

About Capital One Savor

The Capital One Savor Cash Rewards Credit Card is a great choice for dining and entertainment rewards. On dining and entertainment, you will get the 4% cashback. Along with this, you will get 2% at grocery stores and 1% on all other purchases. In this card, you can also earn a $300 initial bonus to the new cardholders, who meet the minimum spending requirements of $3,000 within 3 months from the day from your account opening. It will be enough to cover the cost of your annual fees.

As its name suggests, Capital One Savor Cash Rewards Credit Card is basically built for rewards. This card comes with a very high intro APR, ranging from 15.99% to 24.99% and there will be no introductory rate some your money.

Usually, this card is the best choice for high spenders. You have to spend a minimum of $1,000 per month within the three months to earn the initial bonus. People who are not ready to spend that much amount can go for the other Capital One Credit Card, such as the Capital One SavorOne or Cash Rewards Credit Card. Those cards come with slightly lower rewards rates. But make sure that, you have a good credit score to apply for these cards.

Rates and Fees of Capital One Savor Rewards Card:

Rates:

- APR for Purchases: For purchases, your intro APR will be 15.99%, 21.49%, or 24.99%, depending on your creditworthiness.

- APR for Cash Advances: For the cash advances, you will be charged 24.99%.

Fees:

- Annual Fee: For the annual fee of Capital One Savor Rewards card, you will be charged $95 annually.

- Transfer Fee: For each balance transfer fee, you will be charged 3% of the amount.

- Cash Advances Fee: For each cash advances fees, you will be charged 3% of the amount or at least $10 minimum.

- Late Payment Fee: For the late payment fees, you will be charged at least $39.

Pros and Cons of Capital One Savor Rewards Card:

Pros:

- $300 Sign Up Bonus: Using the Capital One Savor Rewards Card, you can earn a $300 initial bonus. To earn the bonus, the minimum spending requirements are $3,000 within the first three months from the day of your account opening. After you meet the requirements, the bonus will be credited to your account within the two billing cycles. If you are planning to get qualify, then you can go after the Capital One Savor Rewards Card. This initial bonus of Savor Card’s card is one of the biggest cash bonuses available right now.

- 4% Cash Bank on Dining & Entertainment: The Capital One Savor is also the best credit card for dining and entertainment because of its 4% cashback on qualifying purchases. On your other qualifying purchases include plays, professional sporting events, concerts, etc.

- Solid Secondary Rewards: In additional bonus rewards, you will receive 2% cashback at grocery stores. On all your other purchases, you will receive 1% cashback rewards.

- No Foreign Transaction Fees: For the foreign transaction fee outside the United States, you won’t be charging any amount.

Cons:

- $95 Annual Fee: The Capital One Savor Cared charges five times more annual fees than the other fees. With this annual fee, you can unlock all the benefits and rewards.

- High Regular APR: The APR for the Capital One Savor Card ranges from 15.99% to 24.99%. The intro APR is depending on the market based prime rate. The average intro APR is 20.24% for general credit cards. As compared to that, this card charges high regular APR.

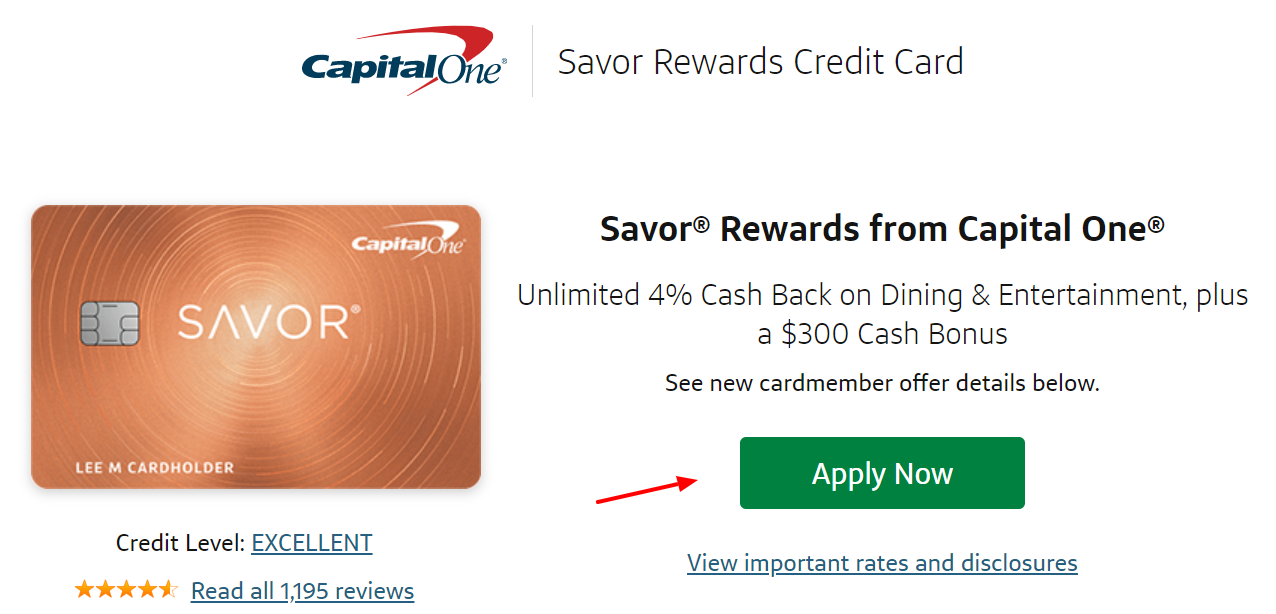

How to Apply for the Capital One Savor Card:

The application process for the Capital One Savor Card is quite simple. You just need to follow some of the basic instructions to complete the application process. You can simply follow these instructions below to complete the application:

- First, you have to visit this link capitalone.com/credit-cards/savor-dining-rewards.

- Then, you need to click on the Apply Now option.

- You have to provide your personal information, such as the first name, last name, date of birth, and the social security number.

- Then, you have to input your contact information, such as your residential address, zip code, city, email, and phone number.

- Then, provide your financial information in the next section.

- After that, you need to click on the Continue button for further steps.

Also Read : Paycard Employee Login

Capital One Customer Service:

If want to know more about the Capital One Savor Credit Card, you can contact the Customer Service of Capital One.

Customer Service: 1-800-CAPITAL (1-800-227-4825)

Online Banking Support: 1-866-750-0873

Outside the US, call collect: 1-804-934-2001

Fraud Protection: 1-800-427-9428 or 1-800-239-7054

Small Business Credit Card: 1-800-867-0904

Mail:

Capital One

Attn: Payment Processing

PO Box 71083

Charlotte, NC 28272-1083

Conclusion:

Capital One Savor Cash Rewards Card is a great option in the world of cashback cards. Here you can earn some best cashback rewards and benefits. If you spend a lot on dining, entertainment, and groceries, then you can go for the Capital One Savor Card.

Reference Link: